…highlights role of Govt. in buffering inflation through cash grants, subsidies

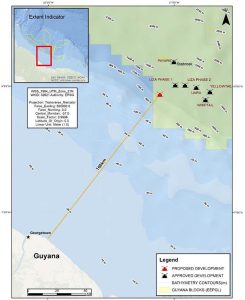

Kaieteur News- ExxonMobil’s seventh proposed deepwater development in the Stabroek Block- Hammerhead – can contribute to higher cost-of-living, specifically resulting in increased cost of certain goods and housing.

This is according to an Environmental Impact Assessment (EIA), conducted by the company’s consultant, Environmental Resources Management (ERM).

Volume Two of the 4232-page document highlights, “With rising wages and increased purchasing power (driven not only by the Project but by broader economic growth and development trends), the Project could also contribute to increased costs of living (IDB 2023).”

The study goes on to explain, “This could manifest in several ways; for example, higher prices for in-demand goods and services, higher costs for housing in desirable areas of Georgetown, and/or higher costs for key goods in the supply chain (affecting both consumers and businesses/suppliers).”

Inflation

ERM noted that Guyana’s inflation rate has risen above “historic levels in recent years” as experienced globally, although these levels subsequently settled below international and regional rates.

Inflation refers to the increase in average price of goods and services.

According to the study, “In Guyana, inflation increased from 2.1% in December 2019 to 6.9% in June 2021 (IDB 2022), settling at 4.7% at the end of December 2021 (Bank of Guyana 2022). In 2022, Guyana’s inflation rate was 7.2%, as compared to a global rate of 8.8%. However, in 2023, the national inflation rate was marked at 2% (compared to 6.8% globally) and predicted to be 2.5% in 2024 (as compared to 5.8% globally).”

ERM suggested that the low inflation rates in Guyana can be attributed to factors that include increasing oil production, which provided revenue and energy security as indicated by the Inter-American Development Bank (IDB) in 2023.

Further, the study pointed to the key roles of government in buffering the impacts from inflation. It states, “Additionally, the Government of Guyana implemented subsidies and price controls on targeted goods to help mitigate imported inflation. Measures such as cash grants, fuel subsidies, and support for the agricultural sector helped stabilize food and energy prices locally and further insulate Guyanese consumers from higher costs faced globally (Ministry of Finance 2023).”

Stakeholders not feeling GDP growth

Meanwhile, ERM said several stakeholders in separate interviews indicated experiencing higher prices in a short period of time in Guyana. This was particularly concerning for consumers who are yet to see the economic benefits of the massive growth in Gross Domestic Product (GDP) the country has recorded since 2019.

Based on its assessment, the consultant found that food prices have recorded the greatest levels of inflation, particularly condiments/spices, vegetables / vegetable products, meat, fish, eggs, and pulses.

The EIA however explained, “The Bank of Guyana and other regional institutions acknowledge that this trend is not unique to Guyana (Bank of Guyana 2024; IDB 2023). Based on the national Urban Consumer Price Index, food prices rose by approximately 50 percent between March 2021 and March 2024 (Bureau of Statistics 2024). In contrast to the escalating price of food, price indices for housing and transportation/communication in Guyana (specifically the Georgetown urban area) have been relatively stable since 2020 (Bank of Guyana 2024).”

In concluding, the document noted that project-related potential impact will be focused on the Georgetown area as the national hub for goods and services, as well as for shorebases and services that support EMGL’s offshore activities.

Further, project-related economic activity will occur throughout the Project’s life cycle- estimated for at least 20 years- which will yield long-term potential impacts.

Original link posted by Kaieteur News on April 15, 2025.